Women and Investing: A Panel Discussion in Celebration of Women’s History Month

By Joe S.Vanguard and the Free Library of Philadelphia will present a lively panel discussion in celebration of Women's History Month on Monday, March 22, beginning at 2:00 p.m.

Sharon Hill, Ph.D., Senior Portfolio Manager and Head of Alpha Equity – Global & Income within Vanguard’s Quantitative Equity Group, will moderate this panel discussion with Jennie Huang, Ph.D., Christine Franquin, and Gemma Wright-Casparius, MBA, three women who are prominent in their fields. The discussion will cover topics ranging from whether women exhibit investment patterns that differ from men’s, what it’s like being part of a team that is in charge of billions of dollars, and how they navigate a male-dominated field.

Below is an interview between Joe Shemtov, Library Coordinator, and Sharon Hill, Ph.D.:

Joe: Sharon, Thank you so much for your time. What brings you to the Free Library?

Sharon: Hi Joe. Public libraries have always had a special place in my heart. When I was a kid growing up in Brooklyn, my family went to the library each week and I remember how it opened up the world to me in so many ways. Back then, reading materials weren't as readily available as they are now on the internet, so I would not have had that exposure were it not for the library. I now live in Philly, so the Free Library is my local library.

Can you tell us how you entered the world of finance?

I came to the world of finance circuitously. I studied math in college and, quite frankly, didn't know what I wanted to do with it—I just knew I loved the logic and internal consistency of it. I was the first person in my family to have graduated college, so I didn't have much in the way of firsthand knowledge of professions that required degrees. After college, still unsure about what I wanted to do, I was fortunate enough to get a teaching assistantship that covered tuition and offered a stipend for graduate school, so I went. After earning a Ph.D., I taught math at Rowan University for a bit but didn't think I wanted to do that for my whole career. My mathematical research involved some programming experience and I had always enjoyed programming. At the time, programmers were in high demand (it was the late nineties). I landed a job at Bloomberg L.P. programming financial software. That role allowed me to combine my math skills with my programming skills and I began to be interested in what the software was being used for: analyzing the financial markets. From there, I went to work for an investment firm and grew from a Programmer into an Analyst. Loosely, I discovered that playing with numbers, drawing conclusions from them, and talking about the results was actually a job! And, today, I am fortunate enough to be working as a Portfolio Manager in Vanguard's Quantitative Equity Group, where we use systematic, math-driven processes to analyze stocks and construct portfolios to benefit our investors.

Is Finance, as a profession, friendly to women—particularly to women of color?

Finance, just like many professions, has an underrepresentation of women and people of color. While I can't speak to the experience of women of color, I can say that over my 20 years in the profession, I have seen things improve for women. In earlier years we were encouraged to conform to the prevailing culture, but now I think diverse styles are being embraced rather than squelched. I hope to see this continue, and I hope to see greater equity for people of color, especially at senior levels.

I know your talk is centered on whether women have an approach that is different from that of men, but can you say something about finance and social equity?

If you think about all of the stock market wealth in this country that is owned by households, Black households only own less than 2% of it. This is clearly connected to broader issues of wealth inequality in our country and is troubling.

What books would you recommend on the subject of finance?

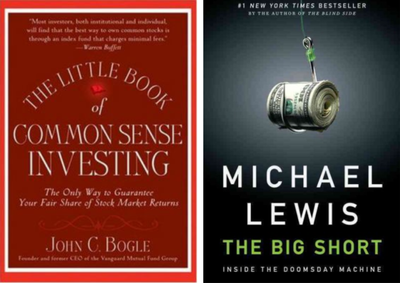

I definitely have to give a shout-out to John Bogle's Little Book of Common Sense Investing. What I like about this book is that it is written for a broad audience and is intended to help all investors. For something with a more nefarious tilt, I would recommend Michael Lewis' The Big Short: Inside the Doomsday Machine. It's an amusing way to find out about the drivers of the Global Financial Crisis of 2008.

Finally, what advice would you give to women who are contemplating careers in finance?

To women contemplating careers in finance, I would say, don't let anyone intimidate you. Competition can be fierce because, after all, these are generally well-paying, exciting jobs. So, there will be people who do a great deal of chest-thumping and self-promotion, things women tend not to do. Ignore it. Carry on. Don't conform to that behavior. I'm not saying that women shouldn't put forth their accomplishments; they should. I am just saying that this can be done in an honest, inclusive manner and women should avoid getting distracted by any old-school behavior that they may witness. The other piece of advice I would give is not to worry about perfection. Sometimes women think that if they can't do something flawlessly, they shouldn't do it at all—I would implore women to take a shot, even if they don't feel 100% ready.

Panelists feature along with Sharon Hill, Ph.D. during this virtual event include:

"Women and Investing: A Free Virtual Panel Discussion in Celebration of Women’s History Month" will be held at 2:00 p.m. on Monday, March 22. Registration is free, but required.

Questions regarding this panel talk should be directed to Joe Shemtov at shemtovj @ freelibrary.org.

Have a question for Free Library staff? Please submit it to our Ask a Librarian page and receive a response within two business days.